Innocent Ephraim, FSDT / Daryl Collins, BFA

Mary in Tanzania walks into a bank branch for the first time. She sees a long line and waits for an hour, feeling scared and anxious as she doesn’t want to ask the wrong question. João in São Paulo walks into a bank branch.

He has to walk through a rotating door that is also a metal detector and gets stuck half-way through. Ly in Cambodia opens an account with an MFI but a month after doesn’t know what to do with the account. Anne who just graduated high school in the United States nervously opens her mobile banking app to make sure she still has money in her account. The emotions associated with financial services are somewhat universal – angst, fear and nervousness. It is rare to hear someone waking up in the morning with a huge smile saying: “I’m so excited about my bank account.”

Negative emotional associations with financial services increase especially when people are resource constrained or don’t understand what happens to money when it’s deposited in a bank. Add on a digital dimension, where those who are illiterate or don’t have a phone have yet another hurdle to surpass, and you have a recipe for failure.

There is a common exception to this rule: savings groups. Savings groups exist under different configurations around the world. The premise is the same everywhere: people in a community save money together and withdraw at different times, sometimes they add a credit component. They’re found in Brazil, Tanzania, Nigeria, South Africa, India, and dozens of other countries. They are called different names and may work slightly differently in each country but the emotional component is always the same. People love and trust their savings groups. They are familiar and have always been around.

How can formal financial service providers (FSPs) offer services that appeal to users? What can FSPs do to create the kind of trust and affinity that people have for informal services? They need to get one thing right: finding the right emotional threshold. If a person feels emotionally connected to a product or service, if it feels familiar, if there is trust, then a customer will feel good about using it.

Linking Known and Unknown

By 2015, the Aga Khan Foundation (AKF) in partnership with the Financial Sector Deepening Trust (FSDT), had established more than 9,200 cash-based savings groups1 with 180,000 savers in rural areas. Two-thirds of all members were women. Collectively, these groups saved more than $60 million since they began, and had an 83% annual continuation rate.

Although AKF’s savings groups have provided unprecedented access to finance for economically and socially excluded populations in the poverty-stricken southeast region of Tanzania, members have been increasingly concerned with a lack of safety for their cash boxes, (which can store millions of shillings at a time). Moreover, cash counting and bookkeeping have become a tedious, time-consuming and labor-intensive exercise. Mistakes undermine group cohesion.

With the support and guidance of Financial Sector Deepening Trust (FSDT), the Aga Khan Foundation (AKF) joined with Selcom and BFA to work on a digital savings group (DSG) product. AKF knows savings group participants, their behaviors and needs and as such has become an innovator of digital and financial design for low income populations in Tanzania.

AKF has found that digitizing savings groups provides an opportunity for members to grow accustomed to using digital financial services within the “comfort of friends” leading to a more confident use of mobile payments for other financial activities. It was clearly a great opportunity to link a known: savings groups and an unknown: digital and formal financial services. This became an opportunity to create an offer with a true value proposition for the end user, a trusted and valuable service.

Designing for Emotions

AKF’s Boresha Maisha (Improve Life!) DSG design process began in 2015 with the objective of eliminating cash and bookkeeping without undermining the cohesiveness of groups. Boresha Maisha platform is cashless and paperless, but otherwise similar to the traditional community based savings group approach. Group members continue to meet physically, retaining the socially supportive role that savings groups play. Today, the platform is testing user experience with live groups in a pilot project to research behavioral change and further improve the offering.

One of the keys to Boresha Maisha’s success is the high frequency of multiple use cases: savings groups pay in, share out, check balances, keep track of loans, pay out a loan. Each use case provides an opportunity for client based service offerings. Savings groups are therefore a natural entry point to familiarize new users with mobile payments, to acquire consistent transactions, and to increase people’s trust and comfort level with other financial services.

Savings groups provide members an opportunity to get used to using digital financial services within a safe community. The more sophisticated members of the group are incentivized to help those less digitally literate to make their own transactions. This allows not only for financial inclusion, but also becomes key in easing people into the financial and digital world through a positive emotional association.

AKF is now piloting its Boresha Maisha DSG platform in Southeastern Tanzania with 11 savings groups for a full 9 month savings group lifecycle. Throughout the pilot, groups are being trained and evaluated on their use of the platform. Insights will feedback into product development as a key component of the design process. At the same time, participating digital groups will be compared to cash groups as a means to provide evidence of how, and whether digital groups really do encourage confidence amongst group members in their use of digital financial services and build a bridge to crossing the digital divide.

AKF’s Boresha Maisha DSG platform is now being piloted in Southeastern Tanzania with 11 savings groups for a full 9 month savings group lifecycle.

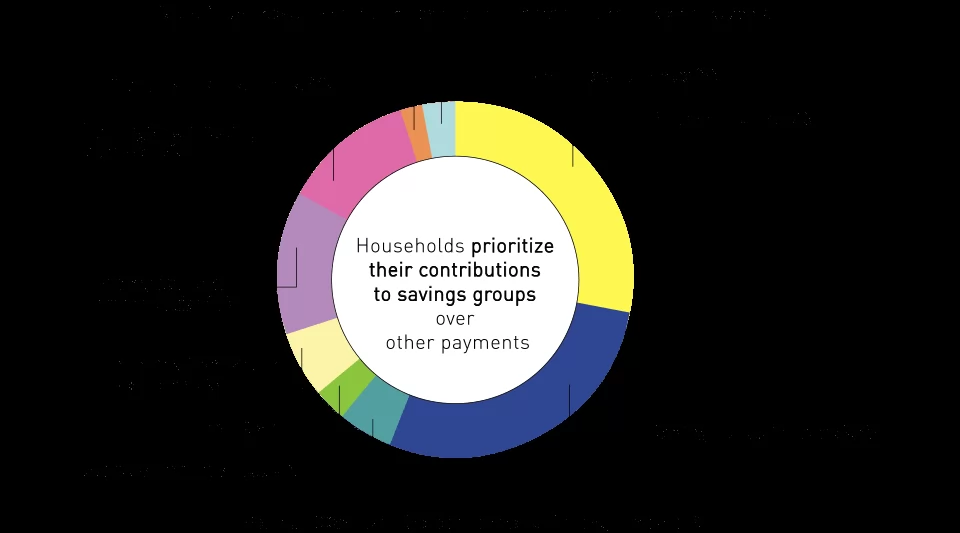

The key to digital financial solutions: Find the Emotional Gateway

Chart 1 below provides a picture of the types of financial transactions that are most important in terms of volume and value for an indicative smallholder household in a village outside of Mbeya, Tanzania. It details all individual transactions that take place in a month. The chart documents that savings groups constitute nearly one-fifth of all transactions this household undertakes in a single month and nearly one-third of the value of all transactions. Similar patterns exist in other household accounts. Qualitative interviews among these households and through Financial Diaries globally have shown that savings groups are emotionally important to households. This qualitative research provides clear evidence that households prioritize their contributions to savings groups over other payments. Emotional prioritization is in part what also led to the success of M-Pesa with its Send Money Home campaign; connecting remittances to filial duty. Part of the emotional attachment to groups stems from the connection and responsibility that members experience in saving and contributing money in a broader community. Savings groups are central to people’s lives – as one South Africa Financial Diaries respondent said: “We would die without our umgalelo (savings groups)”.

While companies and projects often prioritize person-to-person and agricultural payments as key payments to digitize, we see that households have greater volume and value in transactions with their savings groups. Given this, it makes most sense for service providers to focus on acquiring savings groups’ transactions first, followed by other transaction types.

This then forms a big lesson for design: find the emotional transactions in a household portfolio, the ones that are really important, and start creating digital financial solutions there.

The Emotional Tipping Point

The financial inclusion industry still struggles with an age-old challenge: low usage numbers. People register for mobile money and they open accounts in the millions. But use lags far behind, in many cases only 20% of accounts are regularly used. Many FSPs follow a cookie cutter approach. They see something that works in country ‘x’, so they build the same in country ‘y’. “Build it and they will come”, seems to be their motto. Yet for over two decades that point has been continually disproven.

AKF’s experience with the digitization of savings groups offers users something FSPs have not been able to offer: familiarity, trust, community and positive emotional associations. People are only rational actors in behavioral economic theories, but in reality, people make decisions with their hearts and based on their friends’ recommendations.

FSDT’s aim in supporting the design of this product is that it complements the building of an ecosystem of digital payment opportunities for financial services, and very critically, for the micro-businesses that generate the majority of employment in Tanzania. Our hopes are that this product will cultivate a culture of female DFS users given savings groups’ membership is 66% women.

Reaching the right emotional threshold is a win-win: people continue to save in their communities, they save time by connecting digitally, their money is safe and book-keeping is a breeze. People learn to go digital together and their money is safe in an institution that is regulated. FSPs will find the right balance and reach the tipping point they need to ensure everyone can be financially included. They had just missed a key